NOTICE: Internet Explorer was retired by Microsoft on June 15th, 2022 and is no longer supported. This could change how you access Online Banking.

Business Online Banking Upgrade

A new system upgrade for us. A better banking experience for your business!

Our system upgrade is complete! Starting August 2, 2021, Online Banking will have enhanced security and a new login process.

Business Online Banking, now called WesBanco CashFlow Connect, includes using a Company ID as part of your login credentials. If this is your first time accessing our new system, you can find your Company ID by clicking here. You will also use a starter password for your initial login. If you participated in the Preview Period, you will use the password your created at that time. See below for initial login details.

| COMPANY ID : (new) Emailed to you or can be found here. |

| USER ID : (Use your current ID) |

| STARTER PASSWORD : Wbd1 + first three numbers of the Business EIN + Zip code (no spaces) |

Mobile app users

Before accessing Business Mobile Banking, you must first log into Online Banking through the website with the credentials mentioned above and change your password. Then you can download the new mobile app and login with your User ID, Company ID, and new password that you created.

|

|

Details You Should Know

Account numbers (unless previously communicated), debit cards, checks and statement delivery (eStatements or paper statements) will stay the same and it’s banking as usual. See Details on Specific Changes below for more information.

Additional Services:

|

|

|

|

|

|

|

|

The Details: Specific Changes Regarding Products and Services

Click each item for more information!

-

These Online and Mobile Banking upgrades will require that you make changes to your QuickBooks or Quicken software in order to convert your data, so please take action to ensure a smooth transition. Transfer instructions are available below.

The transfer instructions reference two Action Dates. Please use the dates provided below:

1st Action Date: Before 4 p.m. on July 30, 2021

A data file backup and a final transaction download should be completed by this date. Please make sure to complete the final download before this date since transaction history might not be available after the upgrade.2nd Action Date: Anytime after August 2, 2021

This is the action date for the remaining steps on the transfer instructions. You will complete the deactivate/reactivate of your online banking connection to ensure that you get your current Quicken or QuickBooks accounts set up with the new connection.Transfer Instructions

Quicken Conversion Instructions

QuickBooks Desktop Conversion Instructions

QuickBooks Online Conversion Instructions

Intuit aggregation services may be interrupted for up to 3-5 business days. Users are encouraged to download a QFX/QBO file during this outage. The following services may not work during the outage:

- Quicken Win/Mac Express Web Connect

- QuickBooks Online Express Web Connect

- Mint

Please carefully review your downloaded transactions after completing the migration instructions to ensure no transactions were duplicated or missed on the register.

-

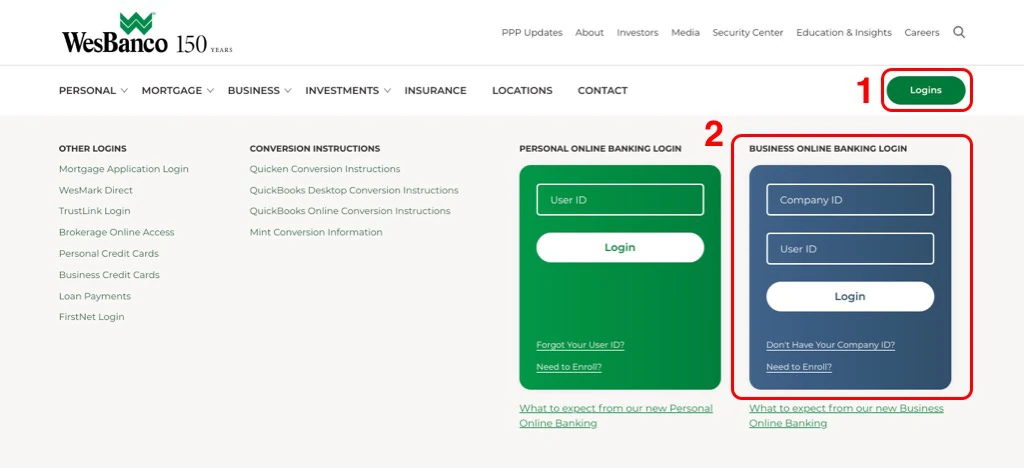

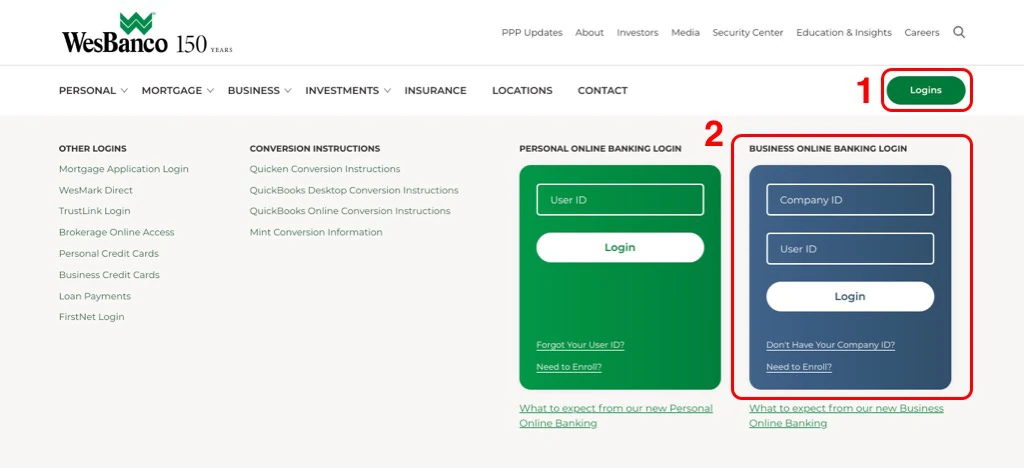

Part of the new online banking experience includes using a Company ID as part of your business login credentials.

You Can Search for Your Company ID Here. After August 2, you can log into your Business Online Banking by selecting the Logins button on the WesBanco website and signing in through the Business Online Banking Login box.

If you did not log into the new Business Online Banking platform, WesBanco CashFlow Connect, during the Preview Period, you will need to establish a new password with your initial sign on:

- Enter your Company ID which was emailed to you or can be found by clicking here.

- Enter your User ID and select Log In.

- A new page will appear where you will perform an Out of Band Authentication (OOBA) using phone numbers we have on file for you. This will require you to receive a one-time passcode to certify your credentials.

- Enter your Temporary Password which is Wbd1 + first 3 digits of your EIN + business zip code and Sign In.

- Change your Password before continuing on to your Business Online Banking.

Please note that 90 days of history will convert on August 2.

Customers who currently receive eStatements will continue to receive eStatements through WesBanco’s Online Banking. We will make every attempt to convert prior eStatement history.

Please note if you are currently enrolled for a loan eStatement, you will need to opt in for eStatements for your loan account(s) again.

WesBanco Bank will never contact you via unsolicited phone calls, emails, text messages, or over any other mediums to request your online banking credentials or personal information. As your bank, we already have that information on file and will therefore never request such information. If you ever question the legitimacy of a request for your information, you should contact the bank on your own to verify the request. -

These Online Banking upgrades come with various enhancements and below you will find some User Guides to help with many functions. These will be particularly useful for business customers that use Treasury Management services.

ACH

Approvals: Approve, Edit and Transmit ACH Files and Requests Guide

Deletions: Delete an ACH File and Request Guide

No Template: Make a One-Time ACH Payment Guide

Reports: View ACH Request History, Upload History and Upload Status Guide

Scheduled: Edit and Delete ACH Payment Schedule Guide

Templates: Create and Use an ACH Template, Edit and Delete Templates Guide

Uploads: Upload and ACH File Guide

Administration

Account Alerts: Account Alerts Guide

Express Account Management: Express Account Management Guide

Setup User Limits: Setup User ACH, Bill Payment and Wire Limits Guide

Users:

- Add a New User Guide

- Assign or Modify User Roles, Entitlements and Services Guide

- Copy a User Guide

- Lock and Unlock a User, Change a Users Password, Delete a User, View User Setup Guide

Loans

Loan Payments: Loan Payments

Positive Pay

Existing Format: Positive Pay – Existing Format Guide

Approve Exceptions: Decision and Approve Exception Items Guide

Enter, Upload, Update and Delete: Enter Check Issues, Upload File, Update and Delete Issues Guide

File Definitions: Add a Delimited File Import Definition, Edit and Delete a File Import Definition Guide

Reports: View Decisions, Issue Status, Outstanding and Stale Issues Guide

Reports

Generate Report: Generate an Account and Balance Activity Report Guide

Stop Payment

Stop Payment Guide: Stop Payment Guide

Transfers

Multiple: Transfer, Edit and Delete Multi-Account Templates Guide

Single: Make and Edit an Internal Transfer Guide

Wire

Approvals: Approve and Transmit Wire, Approve Wire Template Request and Delete a Wire Transfer Guide

No Template:

Reports: View Wire History Guide

Template:

-

Before accessing Mobile Banking, you must first log into WesBanco Online Banking through the WesBanco website.

If you did not log into the new Business Online Banking platform during the Preview Period, you will need to establish a new password with your initial sign on:

- Enter your Company ID which was emailed to you. You may also search for it here.

- Enter your User ID and select Log In.

- A new page will appear where you will perform an Out of Band Authentication (OOBA) using phone numbers we have on file for you. This will require you to receive a one-time passcode to certify your credentials.

- Enter your Temporary Password which is Wbd1+first 3 digits of your EIN+business zip code and Sign In.

- Change your Password before continuing on to your Business Online Banking.

Once successfully logged in, you must enroll in Mobile Banking.

- iPhone and Android users will need to download the new, WesBanco Mobile Banking app from the Apple Store (iPhone) or Google Play (Android) on or after August 2.

- Then delete the old mobile banking app from your phone.

- Log in to your new mobile app using your current ID, Company ID and new password.

WesBanco Bank will never contact you via unsolicited phone calls, emails, text messages, or over any other mediums to request your online banking credentials or personal information. As your bank, we already have that information on file and will therefore never request such information. If you ever question the legitimacy of a request for your information, you should contact the bank on your own to verify the request.

WesBanco Bank will never contact you via unsolicited phone calls, emails, text messages, or over any other mediums to request your online banking credentials or personal information. As your bank, we already have that information on file and will therefore never request such information. If you ever question the legitimacy of a request for your information, you should contact the bank on your own to verify the request. -

If you have established any balance alerts or security notifications as part of your previous Online Banking, they will not convert to the new Online Banking platform and will need to be re-established after Monday, August 2.

-

We recommend that you check your recurring payments and payee information for accuracy after August 2.

Please be aware that your payments may be processed in a different time frame than before; however they will not be processed prior to the effective date.

We will be converting six months of Bill Pay history from the previous system. Please note you will not see this history converted immediately. You will begin to see history starting on August 6, 2021. If you previously scheduled a payment with a deliver by date no later than August 5, you will not see that appear until the history is loaded on August 6.

If you are currently signed up or enrolled for eBills, you will need to re-establish the electronic billing when accessing the Bill Pay service.

-

Here are some considerations to take with scheduled transfers:

- Scheduled transfers on the current system will not convert

- Pending transfers scheduled through 7/30 will be processed on 7/30

- Transfers scheduled after 7/30 will not convert

- Reoccurring transfers will need to be reestablished in the new system

-

You will continue to use your same debit card and it’s banking as usual. You can continue to perform point-of-sale (POS) and ATM transactions, however, balance inquires will be unavailable while we switch to the new system.

- We will have enhanced fraud monitoring of debit card transactions starting August 2. This means your transactions will be reviewed by a newly established system, which may include phone, text or email communications to verify purchases.

- Debit Card Alerts will come from a new number starting August 2.

- Debit card controls will be available within the new WesBanco Mobile app starting August 2.

-

Your statement will have a fresh, new look and layout but the information contained on your statement remains the same. Click here for a preview.

For customers with mid-month statement cycles, you will receive two statements in the month of August, one for the transactions prior to system upgrades and one for the time frame after system upgrades. Each statement will include a statement message indicating that this is a partial. For customers who have an end of month statement cycle, you will only receive one statement in August.

-

Our telephone banking system will be updated by Monday, August 2. You will be required to re-enroll in the upgraded system. Upon first contact, you will need to create a VRU profile similar to our current telephone banking process. You will access the system by calling 1-800-905-9043 and selecting option 1, or call into the system directly at 1-888-664-5300.