NOTICE: Internet Explorer was retired by Microsoft on June 15th, 2022 and is no longer supported. This could change how you access Online Banking.

Economic Outlook First Quarter 2022

Contents

Time Will Reveal

Scott Love, CAIA®, CIMA® | EVP & Chief Investment Strategist

January 16, 2022 — A year ago, vaccination rollouts offered hope that the U.S. would return to pre-pandemic activities. And over the course of the year, vaccination levels climbed. Now with vaccines approved for children between the ages of five and 12, 63.1% of the U.S. population is fully vaccinated against COVID-19, according to the Center for Disease Control. However, major variants of the virus have caused a reinstatement of different limitations. The Delta variant, first identified in India in December 2020, further strained supply chains and slowed the global economic recovery. More recently, Omicron (first detected in November 2021) has caused many organizations and countries to reinstate restrictions.

However, after nearly two years, the U.S. appears to be adapting to this new normal. While economic growth slowed in the third quarter of 2021, largely due to supply chain issues, full-year growth will likely show the highest year-over-year increase since 1984. In addition, the sharp economic recovery has resulted in the shortest recession on record. The National Bureau of Economic Research announced that the recession officially ended in April 2020. At a length of two months, it was the quickest recession on record, easily beating the six-month recession that occurred in 1980.

Despite the number of headwinds faced during 2021, equity markets were less volatile than historical averages. The largest decline for the year was a 5.2% drawdown, the fourth smallest since 1987. Since 1980, the S&P 500 Index has averaged an intra-year drop of 14.0%. For 2021, the S&P 500 Index rose by 28.7% on a total return basis. That was the 21st best finish since 1926.

Over the same period, the Russell 2000 Index increased by 14.8%. Once again, domestic equity indexes outperformed their international peers. For the year, the MSCI EAFA Index reported a total return of 11.9% while the MSCI Emerging Market Index fell by 2.5%. The upward pressure on fixed income yields, a result of higher inflation and the Federal Reserve’s plans, led to negative total return figures for several bond indexes. The Bloomberg Barclay‘s Government/Credit Index declined by 1.75% on a total return basis for 2021.

From an economic and financial market perspective, 2021 could be considered successful. The ability to post decade highs in equity market returns and economic growth speaks to the adaptability of U.S. consumers, business owners, and investors. However, we do not anticipate 2022 will be as smooth as 2021 due to several tailwinds. For the upcoming year, we are focused on several transformative items, including inflation, interest rates, and supply chains.

Cruel Summer

The uneven fight against COVID-19 across many different continents has hurt supply chains, but not broken them. During the summer, the U.S. began to see supply chains tighten as global shipments were delayed. A number of regions continued with zero-case targets, resulting in complete shutdowns of production facilities. Compounding the issues, U.S. ports have been overwhelmed, leading to delayed deliveries and stretched supply chains. Currently, there are 98 ships headed to the Ports of Long Beach and Los Angeles, up nearly 10% over the past two months. However, it appears that delivery delays and supply chain issues are improving. Industrial production and capacity utilization levels are back to long-term averages. More recently, the ISM Manufacturing Report showed clear signs of improvement, led by supplier deliveries and inventories. Supporting the improvement is strong hiring trends. It is also important to note that supply chain progress did not come at the expense of lower demand, as new orders and backlogs remain in expansion territory.

In our view, supply chain bottlenecks have contributed to some of the inflationary pressures. But stress should moderate throughout 2022 as supply constrains ease.

Let’s Go Crazy

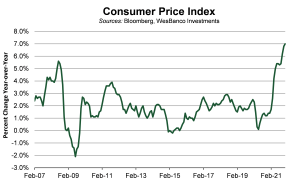

The December Consumer Price Index (CPI) reported a year-over-year increase of 7.0%. The results were the highest year-over-year increase since June 1982, led by gasoline and used car prices. Over the past year, the rebound in oil prices and the supply chain issues related to new car production have resulted in historic growth rates in these two categories. An index of used car prices went parabolic following the start of the pandemic.

Compared to a year ago, the average price of a used car has increased by 37.3%. In the 20 years prior to the pandemic, used car prices fell by an average of 0.3% per year. However, it is important to note that energy and used cars account for 10.9% of overall CPI. Excluding food and energy prices, U.S. CPI rose by 5.5% year-over-year. That was the largest yearly increase since February 1991.

While it seems unlikely that the price of oil will jump another 55% in 2022, or that a five-year-old Honda will again double in value, other factors will likely keep year-over-year CPI above the long-term average. We believe the cost of housing will keep inflation elevated for the year. Shelter costs, which account for 32% of CPI, rose 4.1% year-over-year in the December report. This factor tends to lag in its impact on overall CPI. Based on the increase in prices over the past 12 months, we would anticipate larger increases going forward. Over the past year, the median price for existing homes rose by 13.8% with an average year-over-year increase of 16.6% for 2021.

We anticipate inflation to moderate during 2022. The impact of both COVID-19 stimulus packages is expected to cool, and excesses in demand will taper off. Also, price increases should cool as supply chains recover and inventories return to historical levels.

Rising inflation has the Federal Reserve accelerating talks of increasing interest rates.

“Let’s Hear it for …” Jay

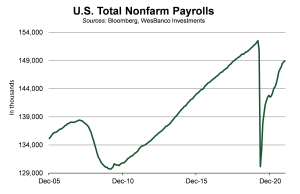

The Federal Reserve has been central to the economic recovery. Over the past several years, low interest rates and quantitative easing programs has allowed liquidity to return to the markets and economy. Following the 2009 recession, the Federal Funds rate stayed at the lower bound for six years. Part of the rationale was: Labor markets need to regain their standing. During that recovery, it took six and half years for the labor market to fully recover. During the 2001 recession, that figure was closer to four years. Currently, the U.S. is less than two years from the previous peak in employment, and the total number of U.S. workers is 97% of the prior employment record.

More recently, the Federal Reserve, led by Jay Powell, has been balancing the dual mandate of maximizing employment while containing inflation. Supported by several Federal Reserve Presidents, the discussion has turned to rate hikes to slow inflation. The view of expected fed funds rates, as expressed by the “dot plot,” suggests three increases in 2022. That marks a shift from the prior view of two hikes during the year.

According to meeting minutes, rate hikes will start “shortly after” the taper ends. Based on the revised guidance of the taper, we would anticipate that to be the end of March. Theoretically, they could increase rates at that meeting, and several have suggested they would be in favor of that. However, over the past several years, the Federal Reserve has liked to communicate any change in views over the course of several meetings. As a result, we believe rate increases will begin in May or June of 2022. This would leave four or five meetings for the rest of the year, allowing three increases for the year. Over the past few weeks, talk of four potential rate increases has gathered momentum. While possible, we believe it is unlikely for a few reasons, including changes to voting committee members, the number of meetings in the year and cadence of communication, mid-term elections, and expected moderation in CPI.

Lastly, the Federal Reserve can allow its balance sheet to run off more quickly than anticipated. This would increase the tightening pace without increasing fed funds rates faster. In the last cycle, the Federal Reserve estimated that shrinking the balance sheet would act as a de facto 0.25% increase in fed funds over six months. The current portfolio is nearly double the prior peak, and thus could have a more meaningful impact.

Round and Round

Higher short-term rates will likely put further pressure on fixed-income securities. At the start of 2021, the yield on the 10-year Treasury was less than 1.0%. However, yields surged in the first quarter to end March at 1.74%. As economic growth slowed, yields fell, closing the year at 1.5%. The overall move in the 10-year Treasury resulted in a -1.54% total return for the Bloomberg U.S. Aggregate Bond Index for 2021. As the Federal Reserve begins in earnest to discuss higher rates, we would anticipate a similar shift in the 10-year Treasury. The subsequent downward pressure on bond prices may result in another year of negative returns in the fixed income space. Part of the cause is the low interest rate environment, as well as the time of maturity for bonds. We continue to believe that fixed income has a place in portfolios. Historically, the low volatility of returns, modest correlation to equites, and consistent income provide a compelling balance to offset other asset classes.

The pricing pressure on fixed income will likely allow equity valuations to remain above the long-term average. The S&P 500 Index trades at 25.6x trailing 12-month earnings, compared to the 35-year average of 18.7x. Supporting the elevated valuation is the above average earnings growth. Earnings per share for the S&P 500 Index fell 19.6% during the 2020 recession. The recovery in earnings has been robust. The consensus expectation is for S&P 500 Index earnings growth of 48.8% for 2021 and 20.8% in 2022. Over the past 30 years, the S&P 500 Index has posted an average annual increase of 9.9% in earnings per share.

Summary

The theme of this Outlook’s section titles are top song hits from 1984, or the last time calendar year U.S. GDP growth was above 6%. That also marked the second calendar year of economic expansion. The following year U.S. economic growth slowed, but it remained well above the long-term average growth rate. We would anticipate a similar trend for 2022 with growth projections in the 4.0% to 4.5% range. The level of savings due to prior stimulus programs, improved employment trends, and pent-up demand related to slow supply chains should be more than enough to offset multiple headwinds.

April will mark the anniversary of the end of the prior recession. Beginning the third year of the economic recovery, a number of data points have surpassed the prior peaks, while many others are close to new highs. Since 1945, the average economic expansion has lasted 64 months. History and current economic readings suggest this recovery is transitioning from early to mid-cycle. With that comes more volatile readings; however, we believe the U.S. is on firm footing and should continue to post above average growth rates over the next several quarters.