NOTICE: Internet Explorer was retired by Microsoft on June 15th, 2022 and is no longer supported. This could change how you access Online Banking.

Individual Retirement Accounts

Individual retirement accounts (IRAs) are tax-deferred, personal retirement plans. You must have earned income to contribute, and you can put money into an IRA whether or not you participate in an employer’s retirement plan.

There are two types: the traditional IRAs, to which contributions may be deductible or nondeductible, and the Roth IRA.

|

Whether you can deduct your contribution or not, you may face a potential 10% tax penalty on top of any tax that’s due on deferred amounts you withdraw before you turn 59 and a half. And you must begin to take required minimum distributions (RMDs) after you turn 70 and a half (or 73 if you were born after June 30, 1949). There’s no tax penalty if you take at least the minimum, but all tax-deferred amounts you withdraw are taxed at the same rate as your ordinary income. Contributions to a Roth are never deductible, but you can continue to contribute as long as you have earned income. And you’re never required to take RMDs.

Contribution Limits

The only requirement for opening an IRA is having earned income—money you get for work you do. Your total annual contribution is limited to $7,000 for 2024, whether you put it all in one account or divide it between a traditional IRA and a Roth. If you’re 50 or older, you can add an annual catch-up contribution of $1,000. You’re eligible whether you’ve contributed to an IRA in the past or not.

Any amount you earn qualifies, and you can contribute as much as you want, up to the annual cap. But you can’t contribute more than you earn. For example, if you earn $1,800 in a year, that’s how much you can put in. And whether you earn $5,500 or $350,000, the top limit is the same.

Spousal Accounts

If your husband or wife doesn’t work, but you do, you can contribute up to $7,000 for 2024 to a separate spousal account in your spouse’s name. The advantage for the nonworking partner is being able to build an individual retirement fund that he or she owns and controls.

Which IRA for You?

If you qualify to contribute to a Roth IRA, based on your modified adjusted gross income (MAGI), or to deduct your contribution to a traditional IRA, you’ll probably want to choose between them.

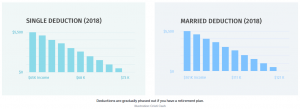

The income limits are stricter for deducting your contribution to a traditional IRA than for contributing to a Roth IRA.

In 2024, for example, you can deduct all of your IRA contribution if you’re single, and you either don’t have a retirement plan where you work or your MAGI is less than $63,000. You can deduct a gradually decreasing portion of your contribution as your income gets closer to $73,000 and nothing if it’s above $73,000. You can always deduct the full amount of your contribution if you’re not eligible for a retirement plan at your job or your employer doesn’t offer one.

You’re eligible for a full Roth contribution in 2024 if you’re single and your AGI is less than $120,000. With an AGI between that amount and $135,000, you can put a gradually declining portion of your contribution into a Roth and the balance into a traditional IRA if you wish.

For a married couple filing a joint return, the income limits for a deductible traditional IRA begin at $104,000, and are phased out at $146,000 for 2024. Either of you can deduct your contribution if you have no retirement plan of your own at work or aren’t eligible. But if your spouse has a plan, the amount you can deduct is reduced gradually if your joint modified adjusted gross income is over $196,000 in 2024, and eliminated if it’s over $240,000. Each of you qualifies to contribute the full $7,000 to a Roth IRA if your joint MAGI is $196,000 or less in 2024 and smaller amounts until it reaches $228,000 when your eligibility is phased out.

It’s Your Account

It’s easy to open an IRA. All you do is fill out a relatively simple application provided by the bank, mutual fund company, brokerage firm, or other financial institution you choose to be custodian of your account.

Because IRAs are self directed, which means you decide how to invest the money, you’re responsible for following the rules that govern the accounts. Basically, that means putting in only the amount you’re entitled to each year and making approved investments. You must also report your annual contribution to a traditional IRA to the IRS, on Form 1040 or 1040A if it’s deductible and on Form 8606 if it’s not.

You can invest your IRA money almost any way you like that’s available through your custodian, from putting it in sedate savings accounts to buying volatile options on futures. The things you can’t choose are fine art, gems, non-US coins, and collectibles. You can buy and sell investments within your IRA and reinvest the money whenever you please without worrying about paying tax on any gains. But you may pay sales charges and other fees on those transactions.

When to Contribute

You have until April 15—the day tax returns are due—to open an IRA and make the deposit for the previous tax year. If April 15 falls on a Saturday or Sunday, your deposit is due by Monday, April 16 or 17, or sometimes as late as April 18.

The longer money is invested, the more it has the potential to grow.

You can put money into your IRA in a lump sum, or spread your contribution out over up to 15 months. You may put in the whole amount the first day you can, January 1 of the tax year you’re making the contribution for. Or, if you’re like most people, you’re more apt to make the deposit on the last possible day, which is April 15 for the previous tax year.

The most practical solution may be weekly or monthly contributions, perhaps as direct debits or electronic transfers from your checking account. There are no guarantees when you invest this way, any more than there are when you invest a lump sum. You could lose money, especially in the short term. But if your investments do well, adding to them regularly can give your account value a real boost. And the longer money is invested, the more it has the potential to grow.

Content is for informational purposes only and is not intended to provide legal or financial advice. The views and opinions expressed do not necessarily represent the views and opinions of WesBanco.

While we hope you find this content useful, it is only intended to serve as a starting point. Your next step is to speak with a qualified, licensed professional who can provide advice tailored to your individual circumstances. Nothing in this article, nor in any associated resources, should be construed as financial or legal advice. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today.

Neither Banzai nor its sponsoring partners make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. Banzai and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release Banzai and its sponsoring partners from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.

Find a Location Near You!

WesBanco operates branches and offices in 8 states. Over the past decade, we have built a national reputation as a safe, sound and profitable bank holding company that always strives to do better by its customers.

Locations