NOTICE: Internet Explorer was retired by Microsoft on June 15th, 2022 and is no longer supported. This could change how you access Online Banking.

Economic Outlook Fourth Quarter 2023

Inflation Has Moderated and Optimism Looking Ahead

Robert McGee, CFA® | SVP & Chief Investment Strategist

Contents

- Economic Overview

- Jobs, Spending, Inflation & Interest Rates

- U.S. Equity, Commodity & Fixed Income Markets

- Summary

The economy has performed better than expected, inflation has moderated and there is optimism for achieving the Fed’s goal of a ‘soft landing’.

Economic Overview

Despite many economists predicting a recession, growth occurred at an annualized rate of 2.1% in the second quarter of 2023. This includes business-fixed investment spending that grew at a rate of 5.2%, its best pace since the first quarter of 2022. This overall performance was in-line with the first quarter of the year.

The Federal Reserve Bank of Atlanta’s GDPNow forecasting model for the third quarter is forecasting 4.9% growth. If the estimate is accurate, it will give the Federal Reserve a reason to continue raising rates. So far, the economy shows resilience in the face of monetary tightening that strains the consumer and pressures business spending. This action may temper growth in the coming quarters.

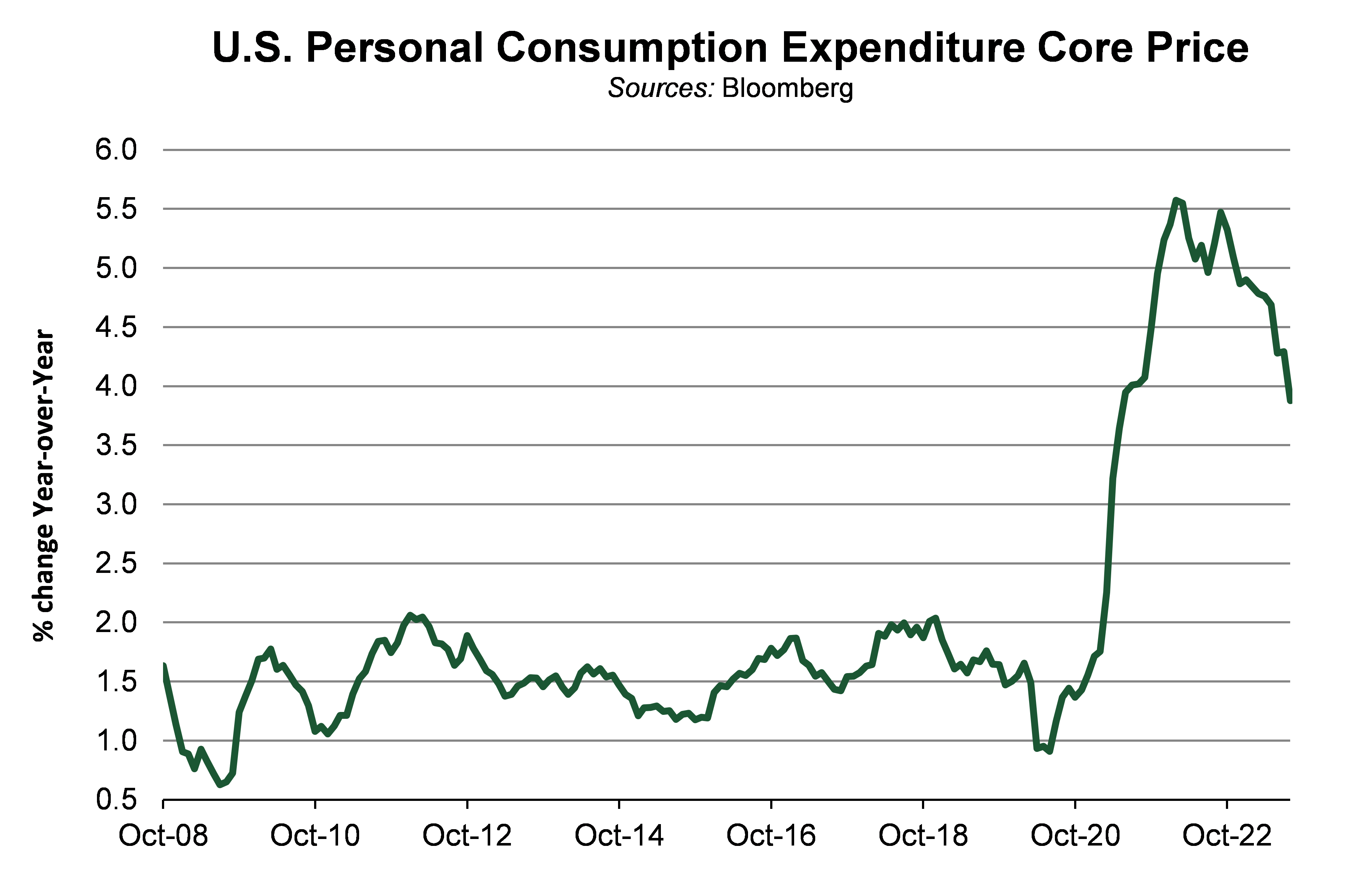

Inflation and wage growth have moderated over the past quarter, but some goods and services have slightly returned to higher prices.

There are still signs that a recession could be on the horizon. Leading indicators, such as an inverted yield curve, offer traditional cues. The Federal Reserve has also indicated it is committed to lowering inflation to 2%.

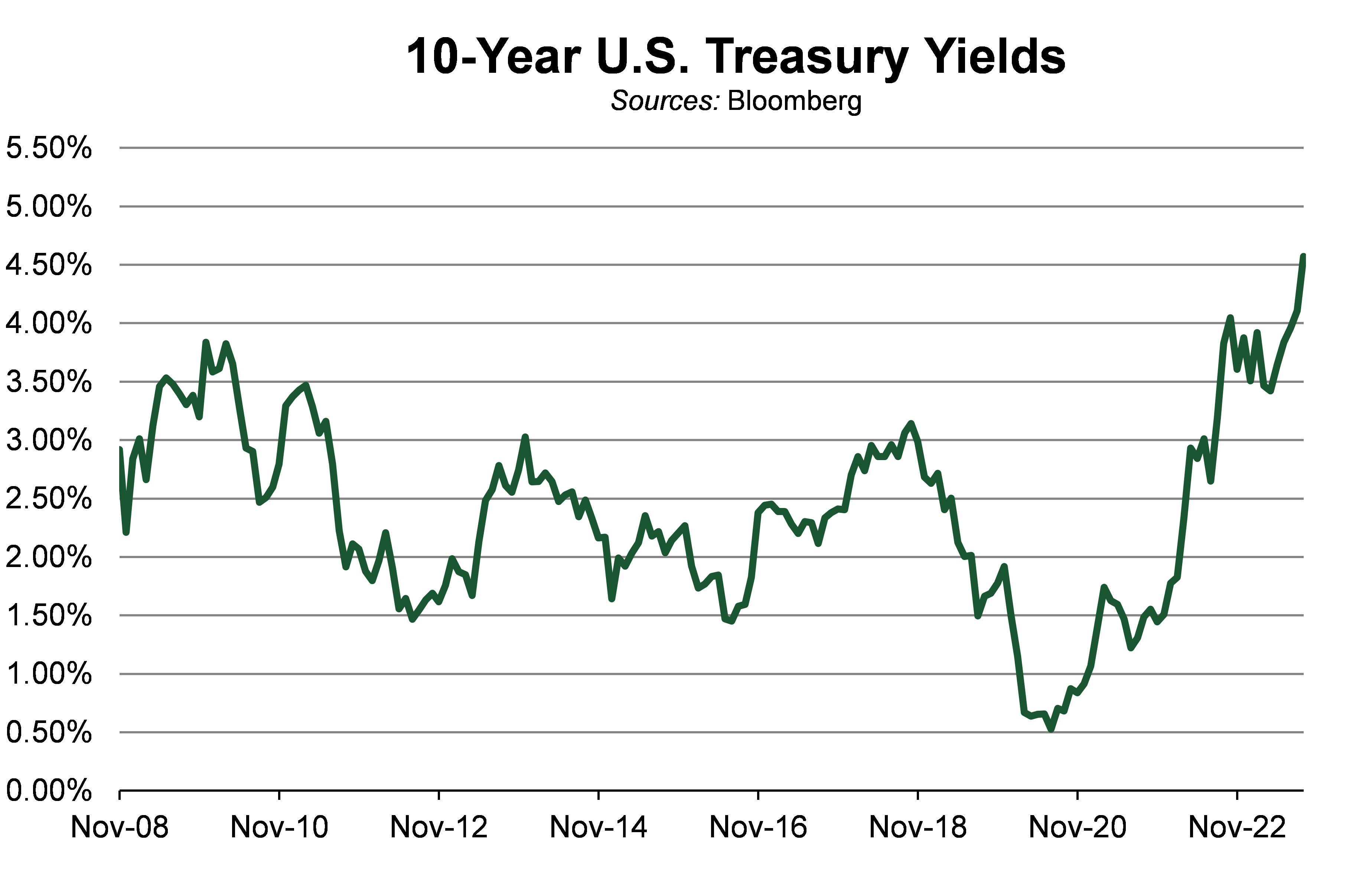

The Federal Reserve has raised rates 11 times since March 2022, with the latest hike occurring in July. The hikes have a delayed effect on the economy with uncertain timing. The Federal Reserve’s actions are designed to create a “soft landing” by raising rates enough to reduce demand and inflationary pressure without causing a recession. The Federal Reserve has indicated that a further rate increase in November may be necessary.

Looking ahead to next year, rates may remain high, as the economy shows signs of stability. The Federal Reserve may cut rates slightly, but it has indicated it sees no need to stimulate the economy at this time. Market expectations were for rates to begin falling in the first half of 2024. But as a result of the Federal Reserve’s renewed outlook, markets have watched 10-year yields rise as expectations for higher rates set in.

In the third quarter, easing inflation and stronger economic growth fueled optimism for a soft landing. Monthly data suggests momentum is slowing; however, there are still risks. Business spending has held stronger than expected due to manufacturing growth and green energy infrastructure projects.

Consumer spending has remained robust due to solid job growth and rising wages. That said, delinquencies are starting to rise. There’s also the forthcoming resumption of federal student loan payments, as a pandemic-related pause ends, and higher energy prices.

Jobs, Spending, Inflation & Interest Rates

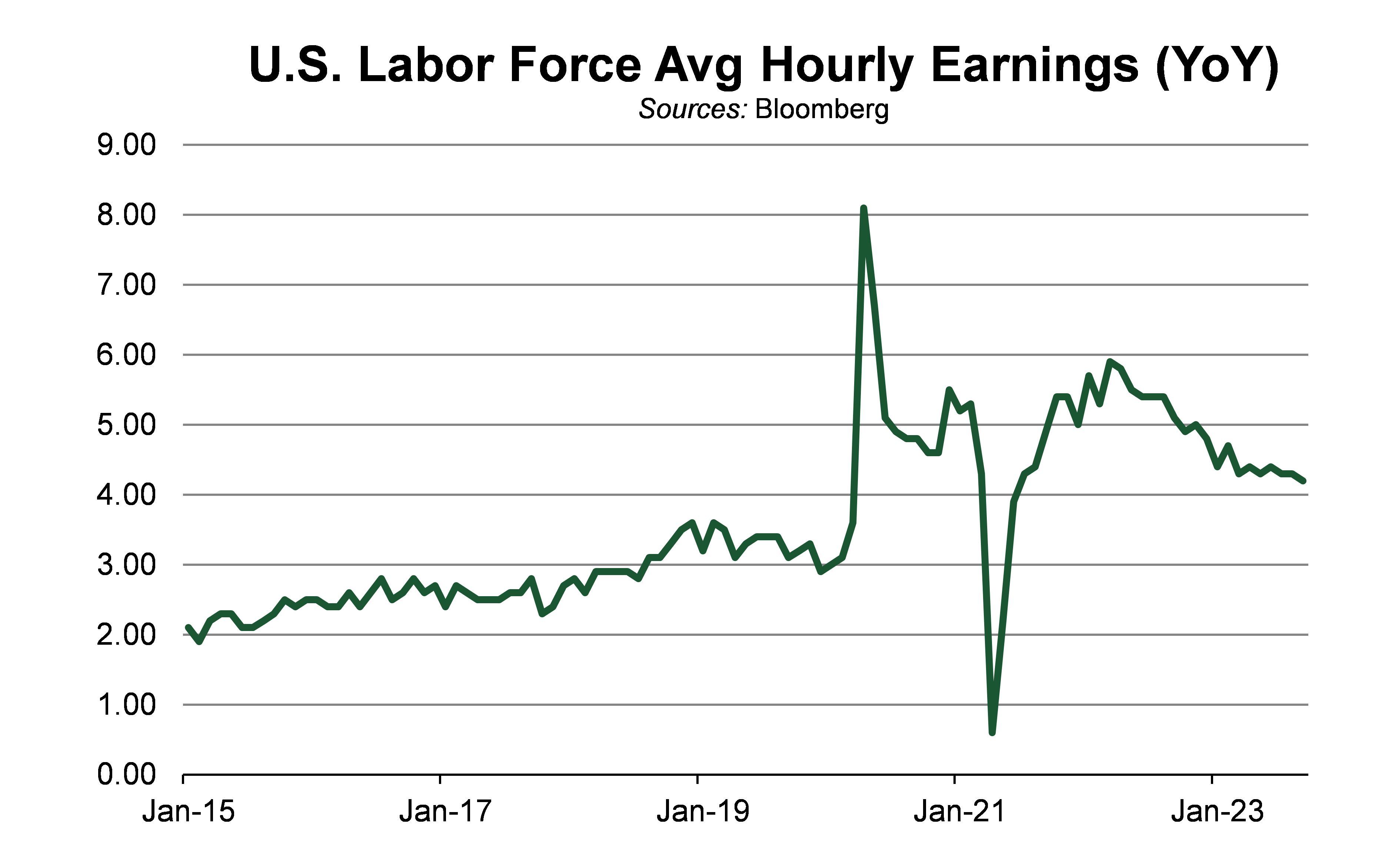

Job growth continues to advance but at a slower pace than in the last 2 years, and more workers are returning to the workforce. This is a positive sign for the economy, but it is also contributing to wage growth. Higher wages can lead to higher costs for goods and services. The pace of job gains, while still robust, has been trending lower since last year. Over the past 3 months, job growth has averaged 150,000 per month.

This is well below the 257,000 average for the trailing 12 months. The labor market seems strong, but slackening demand suggests that job growth may decelerate in the coming months. The unemployment rate continues to hover around its 50-year lows, averaging 3.6% this year. Although still increasing, wage growth has moderated. It has now come down to 4.3% for the past 12 months from a peak of 5.9% in March 2022. While still above its long-term average, this is seen as more catching up to inflation rather than causing it.

The headline Consumer Price Index (CPI) has fallen from a peak of 9.1% year-over-year in June 2022 to 3.7% year-over-year in August. However, August’s reading did see a spike with an increase of 0.6%. This can be traced to higher consumer spending on services and gas prices. The Federal Reserve is watching to see if this is a reacceleration of inflation or just some volatility as things trend downward. While inflation may still be above the Fed’s 2% target, it is gradually falling to more manageable levels.

CPI inflation is expected to decline to 3.0% year-over-year by the end of 2023, and to 2% by the end of 2024. However, with several headwinds facing the economy, the risk of overtightening is significant. The Federal Reserve is near, if not already, at the end of its rate increase cycle. This will divert investor attention to the potential for rate cuts as opposed to rate hikes. If the economy avoids a recession, the Federal Reserve will be able to deliver mild cuts next year. However, if the U.S. economy enters a recession, it may be forced to cut rates rapidly. Policymakers have made a lot of progress in quelling price pressures with minimal economic pain.

However, the list of risks is long, including:

- Higher gas prices;

- Resumption of student loan payments;

- Issuance of more government debt, and;

- A policy mistake of overtightening.

U.S. Equity, Commodity & Fixed Income Markets

U.S. equity markets have been down, led by interest rate-sensitive sectors. The S&P 500 Index was off 3.3% in the quarter. Better company earnings drove the market higher in July, before rising interest rates and global economic outlooks started a sell off. Rising energy prices with West Texas Intermediate crude oil up 28.5% in the quarter led energy stocks up 12.2%.

Telecom, the only other positive S&P 5000 sector, gained 3.1%. S&P 500 Utilities and REITS sectors have been down 9.3% and 8.7% and were loss leaders. Investors who looked to these stocks for better yields have returned to fixed-income securities. Growth versus value was not an investment moving decision. The Russell 1000 Value and Russell 1000 Growth Indexes were within 4 basis points or 0.04%. This appears to present a better opportunity going forward in value stocks, which trade at half the valuation of growth stocks as measured by their price-to-earnings ratios.

Small caps have been down 5.1% as measured by the Russell 2000 Index. They declined, as investors grew concerned about corporate debt becoming more expensive. International equity markets slightly underperformed the US, falling 3.8% as measured by the MSCI All-World ex-US index.

A stronger US dollar and weakening growth in Europe and China weighed on returns. Commodities had a strong quarter, finishing up 4.7%. Oil prices rose as Saudi Arabia and Russia cut supply. The US fixed-income market struggled as yields climbed. In the third quarter, 10-year U.S. treasury rates moved from 3.84% to 4.57%. This change was informed by strong economic data, sentiments from the Federal Reserve and a hefty supply of new bonds coming to market. The Barclays Aggregate Index dropped 3.2% as a result of the increase in rates. This brought the yield to maturity of the index to 5.39%.

Summary

The third quarter of 2023 was a challenging one for investors, with most asset classes posting negative returns. Economic growth and inflation have moderated, and the Federal Reserve is nearing the end of its rate increase cycle. This creates uncertainty over what comes next. Has it raised rates just enough, allowing for steady growth? Or, has the Federal Reserve done too much, leading the US toward a recession?

With slightly high valuations in equities and higher yields in bonds, an investor should consider both fixed income and equity securities and how they fit into their personal portfolio.

Chief Investment Strategist, Bob McGee, gives an economic overview in our Markets & Economy Commentary for October 2023.

Video Player

WesBanco Bank, Inc. is a Member FDIC. WesBanco Trust and Investment Services, a division of WesBanco Bank, Inc., may invest in insured deposits or nondeposit investment products. Nondeposit investment products are not insured by the FDIC or any other government agency, are not deposits or other obligations of, or guaranteed by any bank or any affiliate, and are subject to investment risks including the possible loss of the principal amount investment.

Talk Retirement Planning

Whether you’re opening a new retirement account or interested in rolling over funds, our retirement planning services team can help you make sure you find the right IRA to save for the future. Find a Local Branch and stop by or set up an appointment today.

Locations